It’s about time! Time to create that investment landing pitch deck machine for your solution.

So you’ve developed a solution that is addressing a pain point experienced by a lot of people, you see a market opportunity in it, as a result, you are ready to pitch this solution to investors to get an opportunity to grow and scale this solution.

You don’t want just any pitch deck for this assignment, you need an investment landing, deal raking pitch deck machine. These seven simple steps but highly fundamental will get you that machine. Neglecting any might cost you your investment.

The 7 Ultimate Steps to Creating an Investment Landing Pitch Deck Machine

Contrary to the beliefs of many entrepreneurs, the awesomeness of your product is not enough to land you an investment, so stop raving about how awesome your product is in your pitch deck and follow these 7 ultimate steps in creating a winning pitch deck.

1. Tailor Your Pitch Deck For Your Target Audience

You’ve probably heard this one a thousand times, but I assure you have never heard it this way, and I’m positive that you like many other entrepreneurs are making this mistake.

Do you have one pitch deck you share among different investors whenever you’re asked to submit a pitch? What if I told you this was wrong?

Yes, I know you can’t go designing a new pitch deck for every time you approach an investor, but it is important to have a standard pitch deck that you can easily customize for this simple reason.

Every individual and investor has a unique way of communication and what they are keen on. So before making your pitch or submitting your pitch deck, you may want to research the investor, understand their background, and leverage this data in customizing your pitch deck in a way that resonates with them.

What they are big on, do they concentrate more on the business model, the market opportunity, or the team? You want to know what area of your pitch deck to highlight and magnify certain information.

Taking things even further, you might want to know how that investor communicates. Every single individual has a particular psychological blueprint. Different people relate to different things in different ways. Some are visual, communicating with these individuals is best done using graphics, charts, graphs, etc., and vocabularies like ‘See’, ‘View’, ’Imagine’, etc. Some are auditory, these individuals represent things in their minds using vocabularies like ‘Hear’, ‘Listen’, ‘Disturbing’, ‘Silence’, etc. Others are kinesthetic individuals and communicating with them is best done when they get a sense or feel of what you are saying. They use vocabularies like ‘Feel’, ‘Amaze’, ‘Hold’, ‘Exciting’, etc. Understand this and implement it in your pitch deck.

However, regardless of the psychological buildup of the investor, there are certain must-have slides every pitch deck should have to guarantee landing an investment. We will discuss this further in step 4.

2. Keep It Concise & Simple

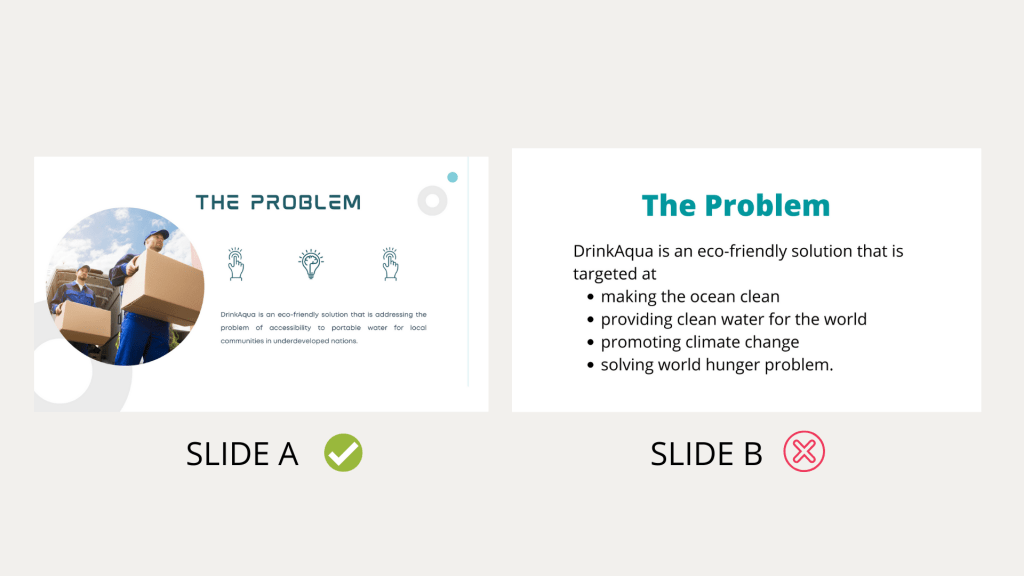

As an investor, which of these slides would you rather pay more attention to, Slide A or Slide B? I’m sure my guess is just as good as yours.

I get that you want the investor to get a full insight into your solution and not miss even a single detail, but trust me, stuffing your slides with endless paragraphs will not get the job done. Here’s a simple way to keep things clean and concise.

Using Words

Use simple and clear words to express your ideas, avoid unnecessary use of industry and technical jargon, abbreviations, etc. Instead of saying “A psychoneurotic depressant which acts on the CNS to induce sleep” say “A drug that helps individuals sleep better”.

Using Numbers

Use numbers and statistics to back up your statements, especially when you know that the investor is visual and analytical. When using numbers, put them in context. Do not say “60% of people lack access to potable drinking water” say “60% of a population of 5 million people (that is 3 million people) lacks access to potable drinking water”. Also, make sure you reference the sources of your data.

Using Images

As discussed in step 1 using images appeals to the psychological blueprint of certain individuals. When using pictures or graphics, use only clear images relatable to the matter of discourse. You want to use an image or graphic that paints a vivid picture of every slide, this will help reduce the amount of effort you’ll have to put into persuading the investor especially if they are visual because they will already get the picture.

Like with numbers and stats, do not forget to reference your sources if you’re not using custom images or buying.

3. Have A Memorable Introduction

The third ultimate step to creating a deal landing pitch deck machine is your introduction.

You don’t want to have a boring introduction, whether you are pitching physically or submitting your pitch deck. You want to have an introduction that jolts everyone up and seizes their attention.

This could be a slide stating the problem which you are addressing in a very ingenious way, it could be jaw-dropping statistics, etc. Whatever it is, keep it simple but make it memorable and attention-grabbing.

For Example: By 2050 we’ll all be dead if we fail to act on this.

4. The 9 Essential Slides In A Pitch Deck

As stated in step one, although every investor has their unique interest and what appeals to them, regardless of this, there are 9 essential slides every pitch deck must contain.

- The Problem

- The Solution

- The Market

- The Product

- The business model

- Traction

- The Competition

- Team

- The Ask

The Problem

This is a very important slide that elucidates the pain point your solution is looking to address, and the gap in the market which you are filling. The problem has to be expressed clearly enough for the investors to easily understand. This is a good slide to utilize the right emotional and psychological language of the investor.

Furthermore, try to focus your solution on addressing one central problem, not a plethora of problems. From my experience, this only confuses people.

For example

The Solution

This is one slide many entrepreneurs get wrong.

Public Notice: The solution slide is not meant for you to discuss your product, no! This slide is a direct follow-up slide to the problem, and it is meant to state the solution for the problem you are solving. For example:

PROBLEM

Access to potable drinking water.

SOLUTION

Solar-powered water taps in every home. (Right)

DrinkAqua is an eco-friendly solution that provides tap water blah blah blah. (Wrong)

Not to worry, there is a slide to discuss your product, but before you discuss your product you want to lay a solid foundation and create enough need for your product so that when it is time to make the introduction the investors already see the need for it. You’ll better understand this in the coming slides.

Also, while stating the solution, you might want to state why it is important now.

The Market

This slide is a major determining factor for many investors. This is where you discuss the market size – Total Addressable Market (TAM), Serviceable Addressable Market (SAM), Serviceable Obtainable Market (SOM), and the market opportunity.

In this slide, you want to make sure to show the growth of the market in the past, current growth rate, and future growth trajectory.

Now imagine telling the investor about your product before telling them about how big the market is. In a situation where the investor isn’t keen on your product, it is easy to lose them even before showing how big the market is. So, the secret is, you want to keep them locked in and entice until you get the opportunity to introduce your product.

The Product

Yap, it’s finally time to discuss your product and I know you’re super excited, but don’t lose it. Don’t get lost in blowing the bells and whistles of your product. In this slide, there are certain key elements you must highlight.

Here you want to put mockups/screenshots of your product or best a link to a demo video. So instead of writing an epistle of how mighty your product is, you just show it.

While using mockups you might want to use very concise bullet points to highlight the key features of the product.

The Business Model

Every investor wants to know how the business they’re looking to invest in will bring them money.

This is where you state clearly how your business will operate and generate revenue. Whether you have a subscription-based or recurring revenue model, a one-off payment model, or any other kind, you must be able to articulate how you’re getting paid.

This slide tells them if investing in your solution is worth it. Investors want to know that you have a viable business model in place even if you aren’t currently making a profit.

Note when an investor gets involved with your venture is either because of one of the following things:

- They have experienced the same problem in the past

- There is a clear sense of ROI down the line for them

- Given their professional expertise they understand it (e.g. doctors with healthcare)

According to a Forbes article, if an investor falls inside the three buckets of interest cited above at the same time, that means you got your lead investor. This may result in you securing at least 20% of the financing of the entire round that you are looking to raise.

Traction

First off, if you’re pitching an idea or maybe you’re a nascent startup yet to record any substantial growth, I’ll advise you to skip this slide.

In this slide, you show the month-over-month growth of the business (e.g. revenue, metrics, etc) and you can do this using figures, a simple table, or a graph like a bar chart or a histogram. Never use complex charts and graphs that only you or your team can understand or explain. Don’t try to look too sophisticated, remember to keep it simple and concise, you’ll be surprised the investor has no idea of how to interpret your graph.

The Competition

Dear founder/co-founders, it will interest you to know that you are not the first to address whatever problem you’re working on right now, there is certainly someone somewhere addressing the same need but probably using a different approach. So avoid thinking this way and research your competitors.

There are two types of competitions; direct competitors which are other businesses doing a similar solution like yours, and indirect competitors which are businesses not using a similar solution, yet addressing the same problem and target audience as you.

Using a diagram is a good way to display this slide. Also, you want to differentiate yourself from the competition & you can do this by stating your competitive advantage somewhere in the slide or maybe in another slide.

Team

Aside from the problem you’re addressing, the market, your product, business model & traction, as an investor, I’ll like to know in whose arms I’m leaving my investment. What type of team is building this product, what’s their background, are they involved or are they committed to it, etc.

Remember ideas are dime a dozen, to successfully execute an idea that will lead to a big business opportunity, you want to put together the right team, and you want to show this team in the right light to your investor.

The best way to showcase the team slide is by just describing the members of the leadership team and then listing in bullet points their achievements relating to the solution or business you’re building now.

The Ask

This is the final must-have slide, due to its importance, it will be discussed as the number 5 ultimate step.

Take note, depending on the stage of your startup and the purpose of the pitch some other slides like Financials might be necessary.

5. The Ask

Missing this slide is as good as never creating your pitch deck.

Come on, you are pitching for a reason. The ask slide is the most important part of every pitch deck. This is where you make your request as regards why you are making the pitch.

Whether you are seeking for funding to scale your solution or you are applying to join a program (maybe an incubator or an accelerator), you have to make the request and state why they should act in the affirmative.

While raising funds, it is advisable to put a range of the amount you’re looking to raise, this is because certain investors and VCs have a cap to the amount of investment they can provide, so setting a range will be a safe option so as not to turn off the investor. For example, if you need $200 million you could say $150 to $200 million in range.

6. Make The Ending Of Your Pitch Deck Memorable

The human mind loses focus easily, before the end of your pitch, the mind of your investor may have juggled thousands of thoughts. Therefore you want to bring them back and draw their attention back to what’s very important, the problem, your solution, and why you need their assistance to solve this now. As always keep this simple and clear.

7. Follow All Steps 1 to 6

The final ultimate step in creating an investment landing pitch deck is simple, you want to follow through steps one through six religiously. Put in the work in doing this, and you’ll create a pitch deck that will rake you deals and investments.